Real Estate

Towards human-centric real estate with a net positive environmental impact

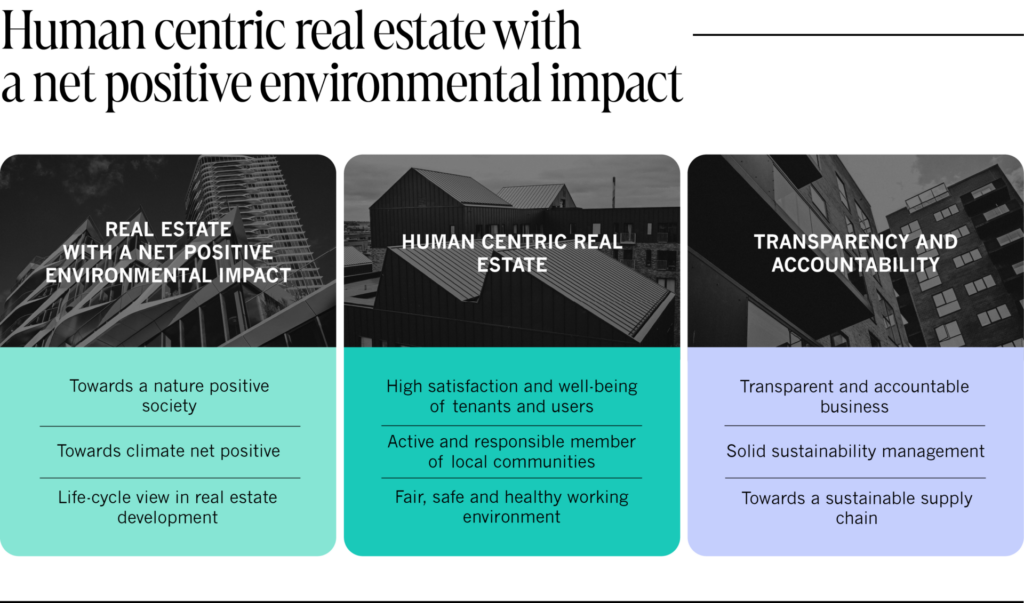

Our sustainability vision is developing human-centric real estate with a net positive environmental impact. We aim to generate attractive returns for investors while driving a green transition in our industry, optimizing real estate life-cycle value creation to all stakeholders, from the environment to local communities. Three themes build into our vision: developing human-centric real estate, moving towards real estate development with a net positive environmental impact, and basing our operations on transparent and accountable governance.

CapMan Real Estate in figures

+4.4

€ billion in real estate under management

+80

real estate professionals

+200

investments

☆☆☆☆☆

GRESB rating*

*According to the latest GRESB assessment, two out of six CapMan Real Estate funds received a 5-star rating, and four received a 4-star rating in the standing investments benchmark.

About us

CapMan Real Estate is a Nordic property investor. We acquire, improve, and develop flexible real estate in major Nordic cities, with a clear focus on developing their environmental and social aspects, recognising our responsibility to create a positive impact on communities.

Our investor base comprises some of the largest global institutional investors and investment management companies who consistently support our ability to deliver strong investment returns through market cycles and across the risk spectrum of our funds.

We execute both value-add and income-focused investment strategies across all major property sectors in Sweden, Finland, Denmark, and Norway.

Our sustainability vision

Our sustainability vision is to develop human centric real estate with a net positive environmental impact. We aim to generate attractive returns for investors while driving a green transition in our industry, optimizing real estate life-cycle value creation to all stakeholders, from the environment to local communities. Three themes build into our vision: developing human centric real estate, moving towards real estate development with a net positive environmental impact and basing our operations on transparent and accountable governance.

Value-Add Strategies

We invest in transitional properties in the most liquid Nordic markets.

Value-Add Strategies

With our value-add funds, we seek to acquire transitional properties in the most liquid Nordic markets where an asset can be significantly improved by active asset management such as redevelopment, change of use, or repositioning. In a typical value-add investment, the untapped potential of a well-located, but under-managed property is captured by bringing the building up to modern standard while simultaneously leasing to high quality tenants on a long-term basis. Most of our value-add investments are sourced off-market through our local network. On completion of the business plan, the re-positioned asset is typically sold via a competitive process to an international or local core buyer.

Active Value-Add Funds

CapMan Nordic Real Estate III FCP-RAIF (2020). A €564 million closed-end fund that invests in commercial and residential properties across the Nordics. Current status: value creation & exit. Institutional investors only.

CapMan Nordic Real Estate II FCP-RAIF (2017). A €425 million closed-end fund which is fully invested in commercial and residential properties across the Nordics. Current status: partially exited with ongoing asset management. Institutional investors only.

CapMan Nordic Real Estate FCP-SIF (2013). A €273 million closed-end fund which is fully invested in commercial and residential properties across the Nordics. Current status: substantially exited. Institutional investors only.

Our Mission

Our aim is to generate attractive returns for investors by utilizing local knowledge and industry expertise to enhance each property investment.

Income Strategies

We invest in income-focused real estate in the Nordic countries.

Income-Driven Strategies (Core & Core+)

With our income-focused funds and mandates, we seek well-located, high quality investments that generate attractive risk-adjusted returns in the long term. The income-profile of our Core and Core+ assets is continuously improved by active asset and lease management. Assets are well-maintained and further developed by diligently following long-term investment programs designed for each property.

Active Income Funds & Mandates

CapMan Residential Fund (2021). An-open-ended structure that invests in residential properties across the Nordics. For institutional investors only.

CapMan Hotels Fund II (2019). A semi-open-ended / evergreen structure that invests in hotel properties across the Nordics. For institutional investors only.

CapMan Nordic Property Income (2017). An open-ended Special Investment Fund, which invests in properties providing stable and predictable cash flow in Nordic growth cities with consistently high liquidity. The fund has a minimum subscription amount of €5,000 and is open for new subscriptions every quarter.

BVK-CapMan Nordic Residential Mandate (2016). A segregated investment mandate with Bayerische Versorgungskammer (BVK) targeting core residential assets in the Nordic countries.

CapMan Social Real Estate (2024). A German special investment fund that invests in properties that are used for providing essential public services. Primarily targeted to German institutional investors.

Select case studies

All funds

| Fund | Year | Raised | Status |

|---|---|---|---|

| CapMan Social Real Estate | 2024 | Undisclosed | Actively investing |

| CapMan Residential Fund | 2021 | €803m | Actively investing |

| CapMan Nordic Real Estate III | 2020 | €564m | Value creation & exit |

| CapMan Hotels II | 2019 | €392m | Actively investing |

| CapMan Nordic Property Income Fund | 2017 | €75m (non-UCITS) | Actively investing |

| CapMan Nordic Real Estate II | 2017 | €425m | Value creation & exit |

| BVK-CapMan Nordic Residential Mandate | 2016 | Undisclosed | Actively investing |

| CapMan Nordic Real Estate I | 2013 | €273m | Generating carried interest |

We partner with

Our professionals across the Nordics

Latest

CapMan Real Estate and Strawberry agree on four lease extensions, three full renovations and one rebranding

CapMan Real Estate sells Seminaari School property in Hämeenlinna, Finland

CapMan Residential Fund awarded Global Sector Leader by GRESB in 2025