CapMan press release

24 January 2024 at 10:15 AM EET

CapMan commits to net-zero by 2040 and sets out to develop framework for driving value creation within planetary boundaries

CapMan commits to become net-zero by 2040, managing its overall real estate and infrastructure assets and portfolio companies in line with net-zero greenhouse gas (GHG) emissions, a decade ahead of the global target. At the same time, CapMan expands its sustainability roadmap to consider nature more broadly, aligning with the latest scientific research on preventing nature decline. To enable this, CapMan is establishing a nature positive framework to drive value creation while staying within the planetary boundaries. The framework will be based on relevant initiatives, such as the Science-based Targets on Nature and the Task Force for Nature-related Financial Disclosures (TNFD). As a result, CapMan has become an early adopter of the TNFD, further solidifying its commitment to sustainability.

CapMan is proud to announce its commitment to net-zero by 2040, adding a long-term date that builds on its current short-term targets, which were validated by the Science Based Targets initiative (SBTi) in 2023. This commitment means that CapMan will manage its overall real estate and infrastructure assets and portfolio companies in line with net-zero by 2040 at the latest, a decade earlier than the global target of 2050. Further and specifically, the real estate portfolio is targeting in-use operational net-zero emissions by 2035, and upfront and in-use embodied net-zero emissions by 2040.

Looking ahead, CapMan is poised to submit its long-term net-zero targets to the SBTi for validation as soon as the financial institution methodologies become available. CapMan Real Estate, a part of CapMan Group, has been selected to participate in the SBTi Buildings pilot test project, where the real estate specific methodologies mentioned above are tested. The real estate net-zero targets will be submitted for validation once the pilot project and the SBTi Building Guidance are finalized.

As an active private asset manager investing across multiple sectors, CapMan invests in companies and properties with significant value creation potential both from a financial and sustainability perspective. Our practical experience from a wide range of industries makes us well-equipped to manage and transition the underlying assets in our funds under management toward achieving net-zero emissions.

Action beyond climate

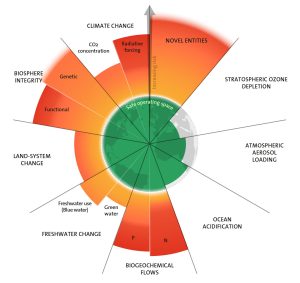

In addition to the climate emergency, the world is facing an even larger crisis, already overshooting six out of the nine planetary boundaries, which represent the critical processes within which humans can thrive. Crossing these boundaries is putting Earth well outside of the safe operating space for humanity. These impacts are already being felt and are expected to grow exponentially, indicating that the current linear economic system of production and consumption is not sustainable in the long run. Policy makers have started responding, and with the deteriorating conditions more stringent regulation is also expected. As an asset manager it is our responsibility to stay vigilant of these changes and prepare our assets, ensuring they remain relevant and profitable in this new reality.

Image: The 2023 update to the Planetary boundaries. Licensed under CC BY-NC-ND 3.0. Credit: “Azote for Stockholm Resilience Centre, based on analysis in Richardson et al 2023”

Anticipating the constraints from the planetary boundaries, CapMan is taking decisive steps to address its wider environmental impacts, dependencies, risk, and opportunities, while integrating climate actions within a larger nature context. To tackle this challenge, CapMan is developing a nature-positive framework that will guide the sustainable transitions of assets and portfolio companies, ultimately aligning them with the planetary boundaries.

“We are proud of our climate targets and commitments, but focusing on climate is not enough. For long-term sustainable operations we need to stay within the planetary boundaries. It is in CapMan’s core to create value which is sustainable in the long run and serves the communities in which we operate. Understanding our dependencies and impacts on nature makes business sense, as it reduces risks and can provide business and growth opportunities. As the scientific community is clear about the direction in which the world needs to go, it’s now time for companies to take this into practice and start building the societies we want to see in the future”, says Pia Kåll, CapMan’s CEO Pia Kåll.

CapMan’s framework will be built around the planetary boundaries approach, a science-based concept applying best practice standards such as Science Based Targets for Nature, Climate, and established reporting frameworks. The practical approach of the framework will be tested and refined with case studies across CapMan’s portfolio. The framework will also help devise concrete nature-positive transition plans for each investment team, incorporating social impacts to enable equitable transitions.

Solidifying its ambition, CapMan has become an inaugural TNFD Adopter, committing to start providing its nature-related reporting in line with the TNFD recommendations for fiscal year 2024 in its financial disclosures package. This commitment places CapMan’s disclosures ahead of the evolving regulatory requirements.

CapMan’s comprehensive approach to sustainability, encompassing both climate and nature positivity, reaffirms the company’s unwavering commitment to responsible investing and creating a more sustainable and equitable future.

“We want to understand how we can put all our real estate and infrastructure investments as well as portfolio companies on the path towards staying within the planetary boundaries, warranting their viability in the future. This way we ensure informed investment decisions and continue creating long-term financial value while driving sustainable transitions. As active managers, it’s our duty to turn scientific insights into actionable, tangible results. It’s a challenging task, but we’re confident it’s achievable,” shares Anna Olsson, CapMan’s Head of Sustainability.

For more information, please contact:

Anna Olsson, Head of Sustainability, CapMan, +46 73 387 75 61

Linda Tierala, Director, IR & Sustainability, CapMan, +358 40 5717895

Pia Kåll, CEO, CapMan, +358 40 766 4446

About CapMan

CapMan is a leading Nordic private asset expert with an active approach to value creation. As one of the private equity pioneers in the Nordics we have built value in unlisted businesses, real estate, and infrastructure for over three decades. With €5 billion in assets under management, our objective is to provide attractive returns and innovative solutions to investors. We have set greenhouse gas reduction targets under the Science Based Targets initiative in line with the 1.5°C scenario. We have a broad presence in the unlisted market through our local and specialised teams. Our investment strategies cover minority and majority investments in portfolio companies and real estate, and infrastructure assets. We also provide wealth management solutions. Our service business consists of procurement services. Altogether, CapMan employs approximately 180 professionals in Helsinki, Jyväskylä. Stockholm, Copenhagen, Oslo, London and Luxembourg. We are listed on Nasdaq Helsinki since 2001. Learn more at www.capman.com.