Sustainability at CapMan Infra and Private Equity

Through our investments across private equity and infrastructure we take an active role in the transition of the broader economy and society, i.e., everyday products and services and utilities, towards more sustainable operating models.

Roadmap for Infra and Private Equity investments

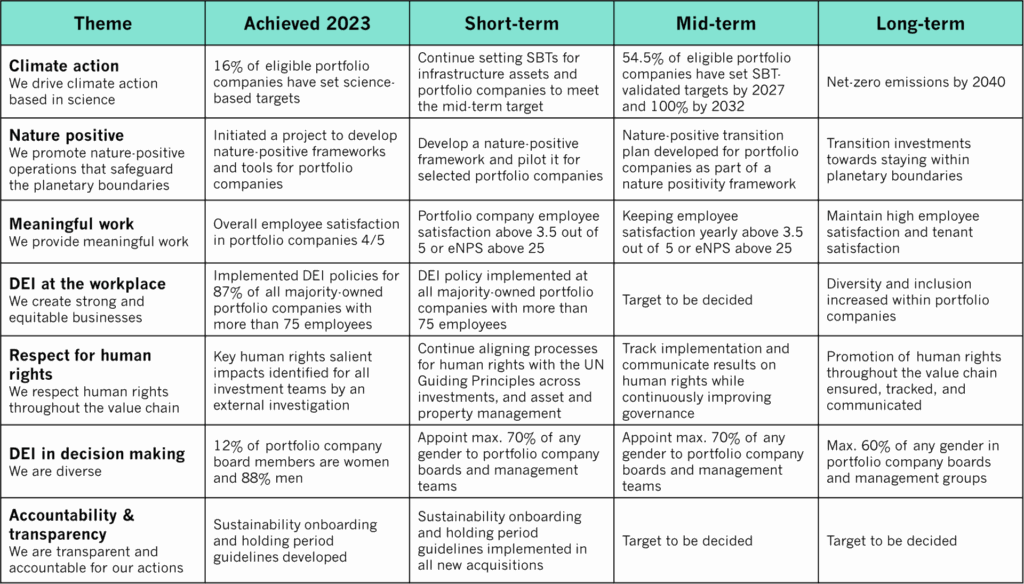

As an active investor, CapMan’s role is to drive positive change in its infrastructure assets and portfolio companies. The sustainability work is based on materiality, meaning that for each asset and company, the focus is on topics that are most relevant for them. In addition, CapMan actively promotes sustainability themes which are material across all investments, and tailors the approach to asset- and company-specific conditions. These themes are Climate action, Nature positivity, Meaningful work, Diversity, Equity and Inclusion (DEI) at the workplace, Respect for human rights, DEI in decision making and Accountability and transparency. CapMan has set short-, mid- and long-term targets for assets and portfolio companies, and progress towards these targets is followed up annually via a sustainability survey. While the Nature positive approach and implementation plan for ensuring the respect for human rights throughout the investment lifecycle are still under development, the following actions are promoted to reach the targets:

• Portfolio companies develop GHG calculation capabilities, set GHG reduction targets and make Science Based Targets (SBT) commitments.

• Portfolio companies measure employee satisfaction and if CapMan is the majority owner and company has over 75 employees, they formulate DEI policies.

• There can be a maximum 70% of any gender in boards’ and management teams’ new appointments, and executive remuneration is linked to sustainability targets.

• As part of the onboarding, relevant portfolio company specific policies are identified which are implemented during holding period. Some policies are mandatory across all, such as a Code of Conduct.

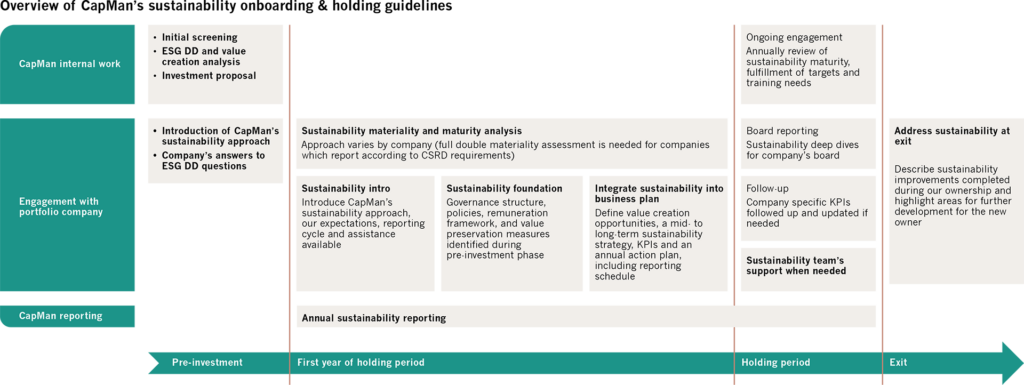

Sustainability work in the investment process, holding period and exit

CapMan integrates sustainability throughout the investment lifecycle from initial screening to exit. CapMan is often the first institutional owner in our portfolio companies, and as such we play an important role in establishing sustainability processes and objectives. CapMan’s Sustainable Investment Policy describes our approach and commitment towards the integration of sustainability within our investments and our Restriction list limits sectors and activities in which we invest. In order to ensure a systematic approach to sustainability work, CapMan has developed Sustainability onboarding and holding period guidelines for our private equity and Infrastructure investment teams to define and guide how sustainability matters should be addressed both during CapMan’s investment processes and when working with our portfolio companies. CapMan’s Sustainability and Value Creation team takes an active part in the process. The guidelines can be split into three phases: pre-investment, holding period and exit.

The pre-investment phase starts with an initial screening of investment opportunities. Each fund has pre-set sustainability qualification and restriction criteria to define what kind of investments the fund can make. Once a potential portfolio company has been identified and the investment process initiated, a risk assessment is conducted via CapMan’s proprietary ESG Due Diligence (DD) and Value Creation tool. This can be accompanied with a more comprehensive ESG DD led by an external consultant. The tool helps investment teams to also identify material sustainability topics which the company can further analyse and pursue to gain competitive advantage compared to its competitors. We call this utilisation of business opportunities sustainability value creation. The reporting readiness of the company is also assessed to determine how well the company can deliver the sustainability metrics which CapMan collects annually. Finally, the results obtained during the pre-investment phase are properly documented and included in the Investment Proposal that provides relevant information for the investment decision.

After the acquisition, the new portfolio company is introduced to CapMan’s sustainability approach, sustainability roadmap, reporting and development expectations, and the support we can provide. The next step revolves around strengthening the company’s sustainability foundation, which covers baseline sustainability processes, governance structures, relevant policies to guide its operations and linkage between remuneration and key KPIs. We provide practical tools, such as CapMan’s policy library to support companies during this development work. It is also important that the findings of the risk ESG DD made during the pre-investment phase are addressed at this point. During the business planning, sustainability becomes an integral part of strategy and progress is followed up regularly with relevant KPIs. While working with the portfolio companies we also progress CapMan’s sustainability targets and ensure that companies obtain the required training on both emerging sustainability topics and on reporting requirements to ensure the comparability of the data across our investment portfolio.

Finally, at exit, we describe sustainability improvements completed during our ownership and highlight areas for further development for the new owner.

CapMan’s ESG DD and Value Creation Tool

CapMan designed and systematically applies its proprietary ESG DD and Value Creation tool in order to analyse assets and companies in the pre-investment phase. The tool helps the investment teams conduct an ESG risk due diligence and provides industry specific deep dive due diligence questions. The tool is based on the target’s SASB Standards’ industry classification and the associated material topics, which can further be customised. Using a risk-based approach, the tool ensures that the target is in line with CapMan’s Restriction list and evaluates its sustainability maturity. These questions evaluate how well the asset or company has addressed its material sustainability topics, how much focus stakeholders have on these topics and how important these topics are for company’s business model. Finally, the tool provides recommendations for value creation. Value creation opportunities are analysed based on both financial and impact materiality.