CEO’s review 2023

Continued growth in fee profit as our strategy advances

We are today building the society we want to see in 2040. The long-term

perspective of private assets allows us to align with our vision for the future as

we carry out active value creation that integrates sustainability factors.

Fee profit continued to grow

I started as CapMan’s CEO in March 2023 at a time when many industry practices were being put to the test. Rapid interest rate increases during the year and growing geopolitical uncertainty have impacted the parameters driving investment activity. The M&A market is slower, fund return requirements have risen, and the fundraising environment is more competitive than ever before.

Challenging periods demonstrate the in-built resilience of investing in private assets. It is during times like these that the funds that outperform the market are created and the best deals are made. Our mission is to create value for our investors while we promote a sustainable and human-centric society through

our investments.

Active value creation that integrates sustainability is in CapMan’s DNA. It is the key to attractive returns on investments over the long term, successful growth and increasing shareholder value.

Now is an opportune moment to invest in growth. Our objective is to double our assets under management to EUR 10 billion by 2027. During 2023, we have strengthened our Real Assets investment focus with the introduction of new funds and expansion of existing investment strategies and they now account for 70% of our assets under management. Real Assets includes real estate, infrastructure and in the future also timberland and natural capital following the acquisition of Dasos Capital. Our Private Equity funds remain on track with their value creation agenda, laying the ground work for further expansion. Due to these and other fundraising projects ongoing this year, assets under management are expected to grow significantly in 2024.

Fee profit, which is a key metric of our business, continued to grow for the fourth consecutive year, although the result was significantly weaker due to lower carried interest and fair value changes of especially external venture capital funds.

CapMan’s ability to attract international capital supports growth targets

Despite a more challenging fundraising market, we succeeded in expanding our customer base even further among international institutional investors. During 2023, we raised nearly MEUR 400 in new assets under management. Over half of that capital came from outside the Nordic countries and about

a third from investors who made their first investment in a CapMan fund. This is a testament to the strong value creation of our funds, the ability to realise value for investors, and to make new and attractive investments despite the slow transaction market and uncertain operating environment.

Private assets are maintaining their position as an attractive asset class globally. The unlisted market is also becoming more mainstream, offering a wider range of investors the opportunity to invest in segments that are not covered by the listed market. This allows players like CapMan to offer new and bespoke solutions to a previously largely untapped investor base.

Progress towards a net-zero and nature-positive society

As an active private asset manager, CapMan invests in companies and properties across multiple sectors with significant value creation potential both from a financial and sustainability perspective. It is in CapMan’s core to create value which is sustainable in the long run. In 2023, the Science Based Targets initiative (SBTi) confirmed our mid-term greenhouse gas emission reduction targets, which we track our progress against. As a natural progression, we have now committed to achieving net-zero emissions by 2040 and to manage our real estate and infrastructure assets and portfolio companies in line with net zero by 2040 at the latest, a decade earlier than the global target of 2050.

Although working proactively towards climate goals is important, it is not enough. The world is overshooting six out of the nine planetary boundaries, which represent the critical processes within which humans can thrive. For long-term sustainable operations we need to stay within the planetary

boundaries. As a solution, we are therefore one of the first in our industry to launch an initiative to promote nature-positive business models across all our investment areas.

We have now committed to achieving net-zero emissions by 2040.

Focus on active value creation across strategies

I am pleased that our Infra and Private Equity investment strategies continued to demonstrate strong development in 2023. This is evidence of our ability to actively create value even in an uncertain operating environment. In total, we made 12 new investments and seven exits in 2023.

The Infra team made three investments during 2023 from its second fund. The acquisition of Serverius, a data centre in the Netherlands, and Fuzion, a data centre in Denmark, expanded the fund’s portfolio into new geographies. Early in the year, CapMan Infra invested in Napier, a Norwegian salmon harvest vessel operator.

For Real Estate, the repricing of the property market creates investment opportunities. The large share of institutional investors in our real estate funds and the closed-end nature of most funds protects them from redemptions and the team can focus on value development in the portfolio without pressure of early exits to meet liquidity requirements. During 2023, we invested in a Swedish logistics centre project

and residential properties in Copenhagen and the Helsinki area, as well as exited warehouse and industrial properties in Denmark and Sweden.

We also expanded our real estate platform as we established the Social Real Estate fund, which targets EUR 500 million in equity commitments. The fund invests in essential public service properties across the Nordic countries and made its first investments in school facilities in Helsinki and Copenhagen.

Nordic Real Estate IV, our flagship real estate fund, is preparing for fundraising. We expect it to hold its first close in 2024 and reach a final close of EUR 750 million.

Private Equity strategies continued implementing their value creation agendas throughout the year. Growth exited Coronaria and invested in Silmäasema. The establishment of the third Growth fund in the beginning of 2024 is a testament to the strong track record of the team. Buyout exited Malte Månson and continues to realise value from the portfolio. Special Situations closed its first fund and invested in Aro Systems, a property management company, early in the year. The current economic situation favours the fund’s flexible and event-driven strategy. Nest Capital, our private debt arm, also benefits from the current market situation. The team made three new investments during the year and exited one investment.

A workplace where top talent succeed and develop

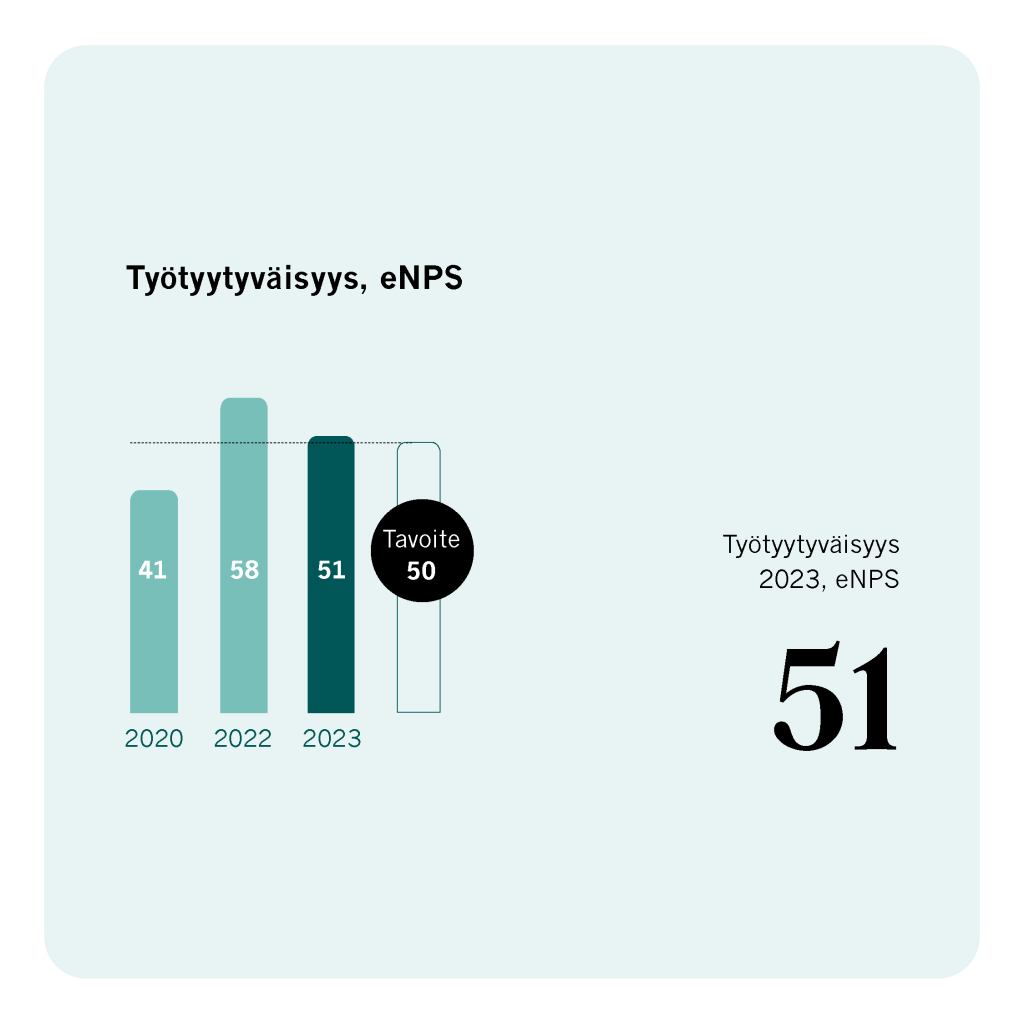

Our strength is the combination of highly motivated experts in their respective fields and a strong team spirit. Successful value creation is built on highly skilled, motivated and thriving personnel. During the year, we invested in the development of our personnel. We have measured our wellbeing at work for several years, and our employee Net Promoter Score (eNPS) continues to exceed our target level (50 eNPS). The indicator measures employees’ willingness to recommend CapMan as an employer. CapMan’s work culture is described as inspiring, and employees feel that the workplace community supports high performance and professional fulfilment. Measured by almost all indicators, we outperform our peer group in terms of workplace attractiveness, and we strive to continue with our positive development also in the future.

Shareholder value through participation in building a sustainable society

As the CEO, I am confident in our ability to achieve our strategic goals while contributing to building a sustainable society in partnership with our portfolio companies and assets. The long-term outlook for the private assets market is strong, and the current softer business cycle favours companies such as CapMan that employ active ownership and sustainable value creation strategies. We create tailwinds in market headwinds.

I would like to thank CapMan’s investors and shareholders for their trust and all our employees for their good work and commitment to our common goals. We continue to implement our strategy systematically and are well positioned to achieve our growth objectives. The measures we have taken build a more international, sustainable, and financially stronger private markets frontrunner.

PIA KÅLL

CEO, CAPMAN PLC

Latest reports

See our latest reports to find out how we build value for the enrichment of society while driving sustainable change and pursuing our strategic objectives.