Our principles

Relationships

CapMan emphasises building long-term relationships with its institutional investors. Relationships with our fund investors are best built by providing superior returns and investor services.

Transparency

Through our transparent approach we build trust among the investors. CapMan’s own fund investments are important in aligning its interests with those of the institutional investors.

Global reach

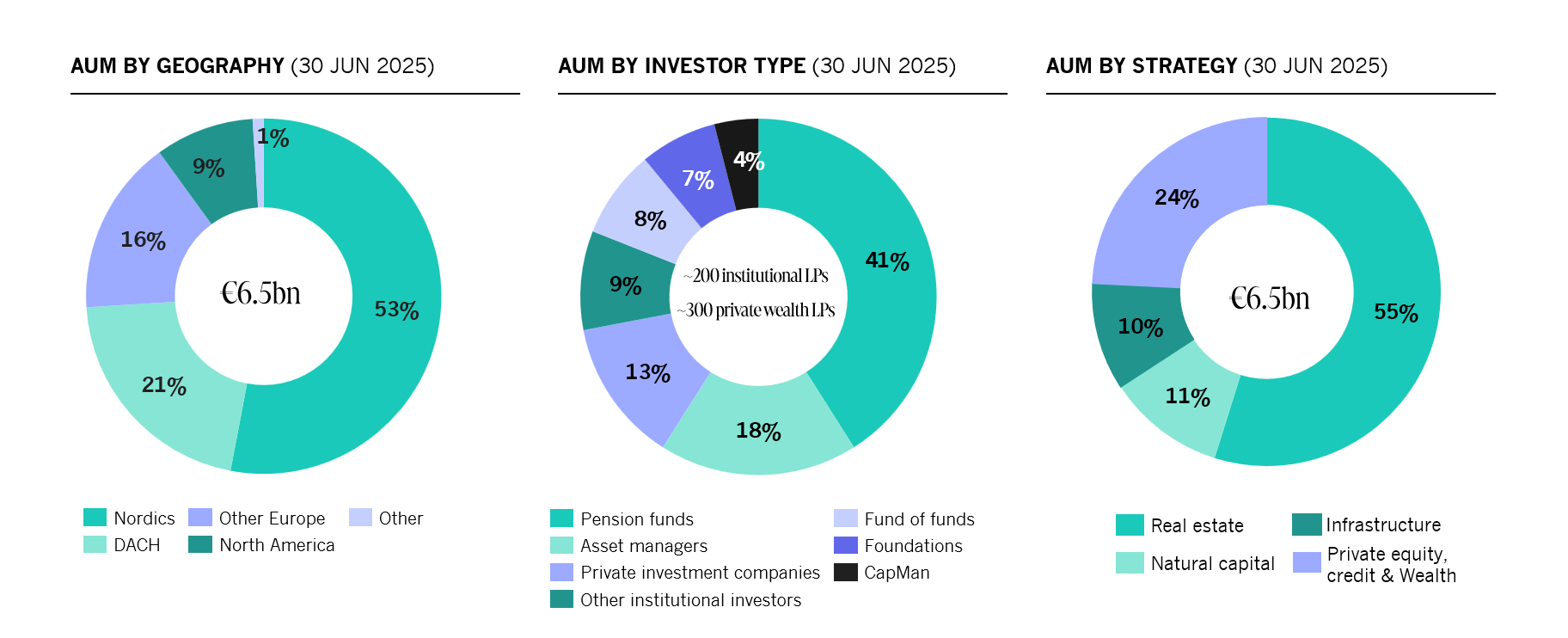

We are determined to further broaden and extend the reach of our international investor community. Our funds are domiciled in Finland, Luxembourg or Guernsey.

Valuation principles

Valuation of CapMan funds’ investment targets is based on international valuation guidelines that are widely used and accepted within the industry and investors. CapMan always aims at valuing funds’ investments at their actual value. Fair value is the best estimate for the amount for which an investment could be exchanged on a reporting date in an arm’s length transaction between knowledgeable and willing parties.

CapMan continuously monitors the fair value development of its investments. Portfolio companies are valued four times a year in conjunction with CapMan Plc’s interim financial reporting.

Valuation process

In the first phase of the valuation process investment professionals responsible for portfolio companies, together with the Performance Monitoring team, make proposals on the valuations of investment targets and compile material to support the valuation levels. In the following phase the Group’s Performance Monitoring team, which is independent of the investment teams, checks the correctness of the principles applied in the proposals and the continuity of the principles used between different investment targets and different points of time. The Performance Monitoring team also drafts proposals to the Valuation Committees.

Each fund has its own Valuation Committee. The task of Valuation Committees is to assess valuations and ensure that the same valuation principles are consistently applied in all portfolio companies, and that the principles comply with IPEV guidelines. The committees comprise of CFO, Head of the Performance Monitoring team, and either Risk Manager of the fund or Head of Investment team.

In the last phase of the valuation process the fund auditors, representing the fund investors, audit the material supporting the calculations and ensure that the valuation methods are in line with fund agreements and IPEVG guidelines. In addition the CapMan Plc auditors audit that valuations for CapMan Plc’s own fund investments are made according to IFRS standards.

CapMan reports to its fund investors on the status of its funds in compliance with fund agreements, InvestEurope guidelines, applicable legislation, accounting regulations, and other statutory requirements. The funds’ investments in portfolio companies are valued in accordance with IPEV-guidelines, while the valuation of real estate investments is based on assessments provided by independent external experts. The reporting typically takes place quarterly, but the frequency may vary in line with the fund agreements.